To Add/Update Employee Standard Deduction

To Add New Employee Standard Deduction

It can be done in 2 methods:

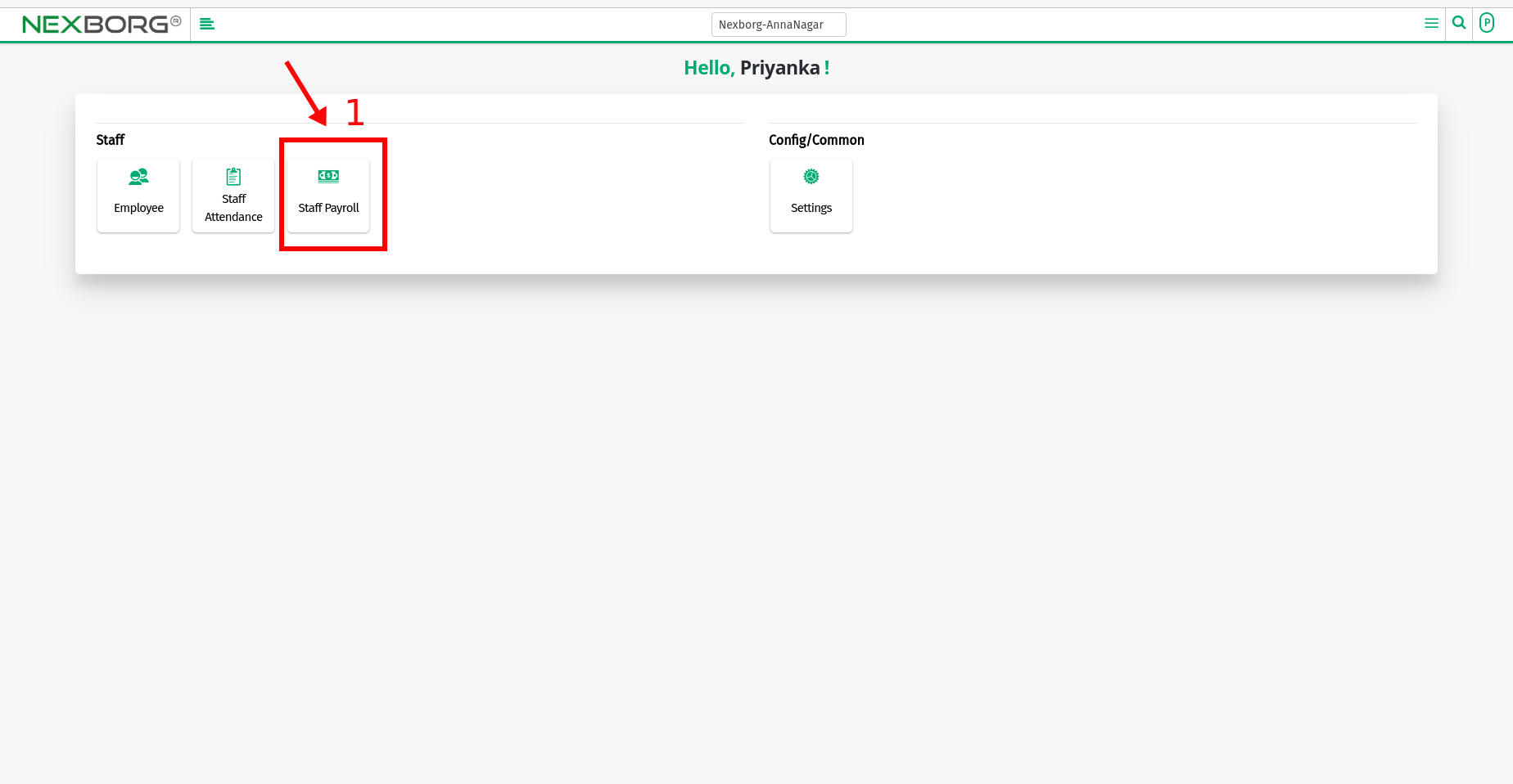

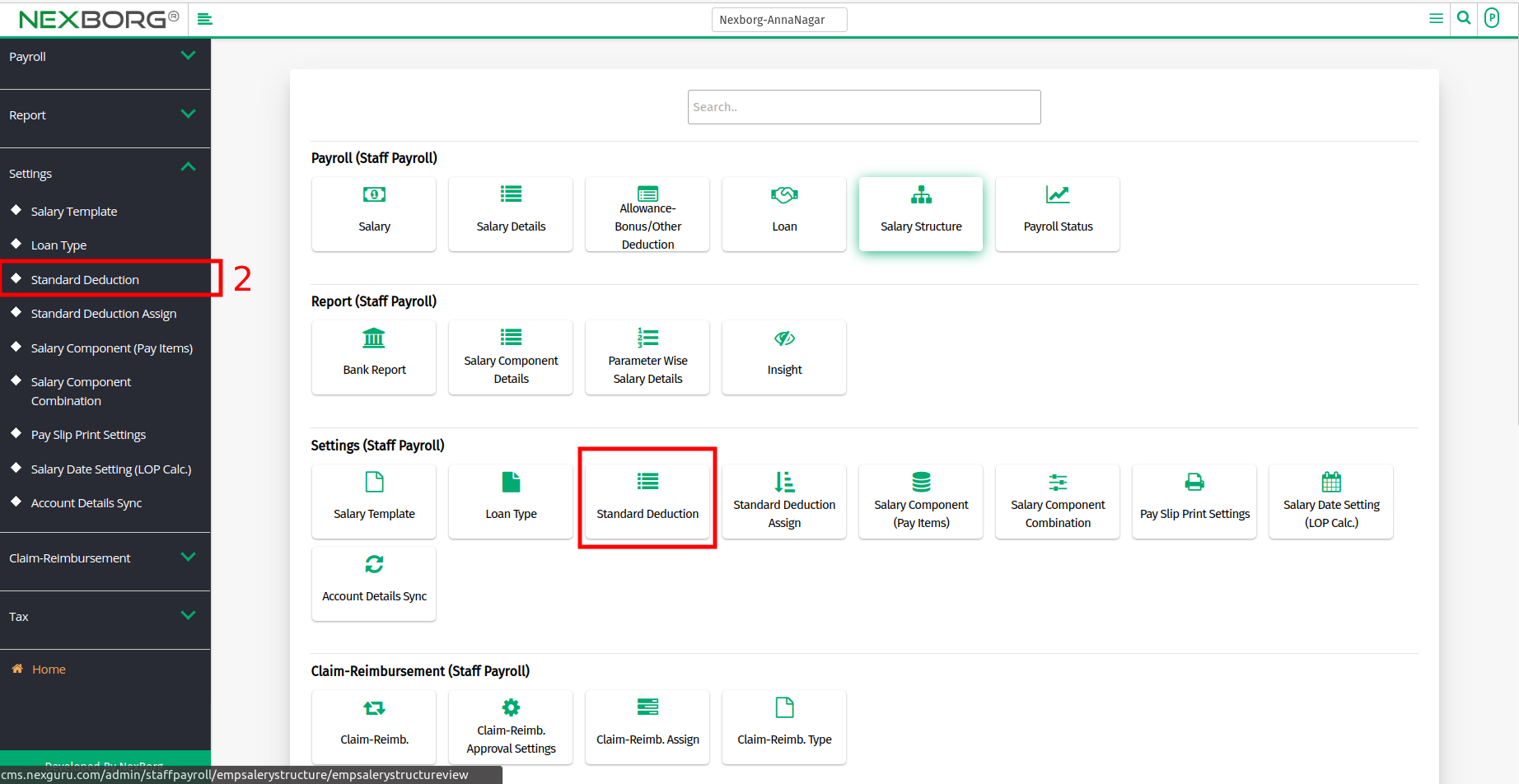

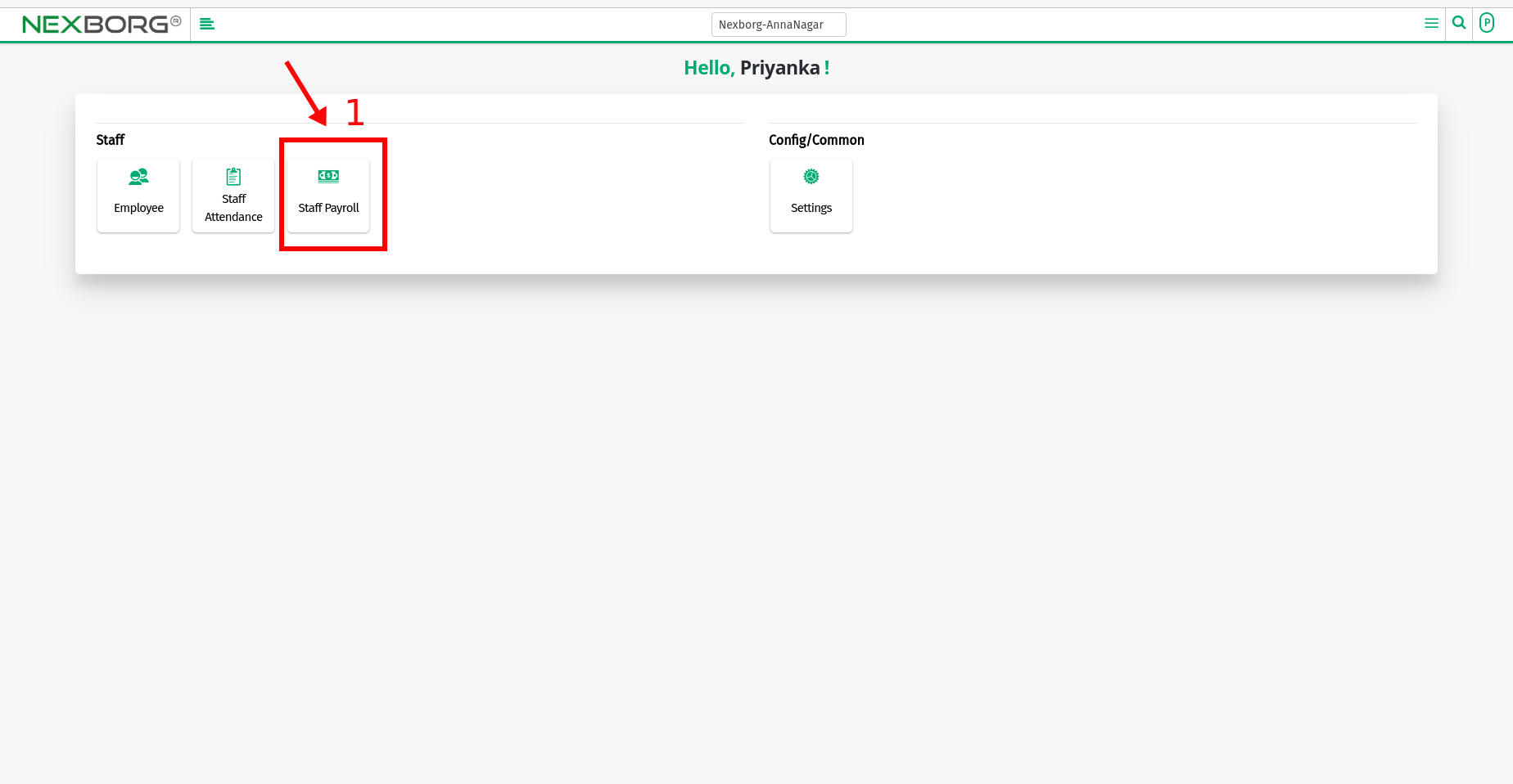

- Method 1: Go to the Payroll module --> Click on Settings on the left navigation bar --> Select Standard Deduction or use the Standard Deduction button in the Settings menu.

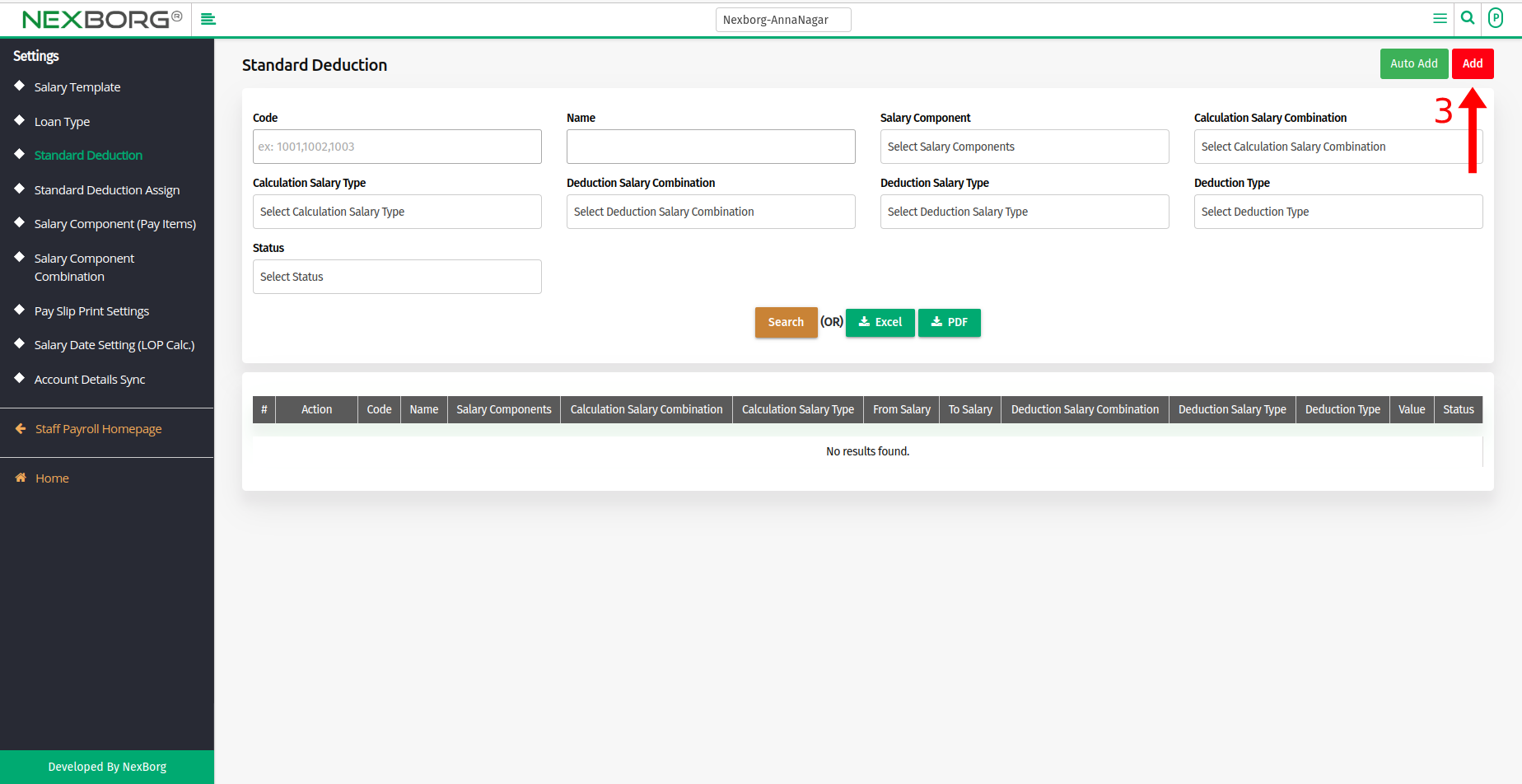

- Click on the "Add" button in the top right corner.

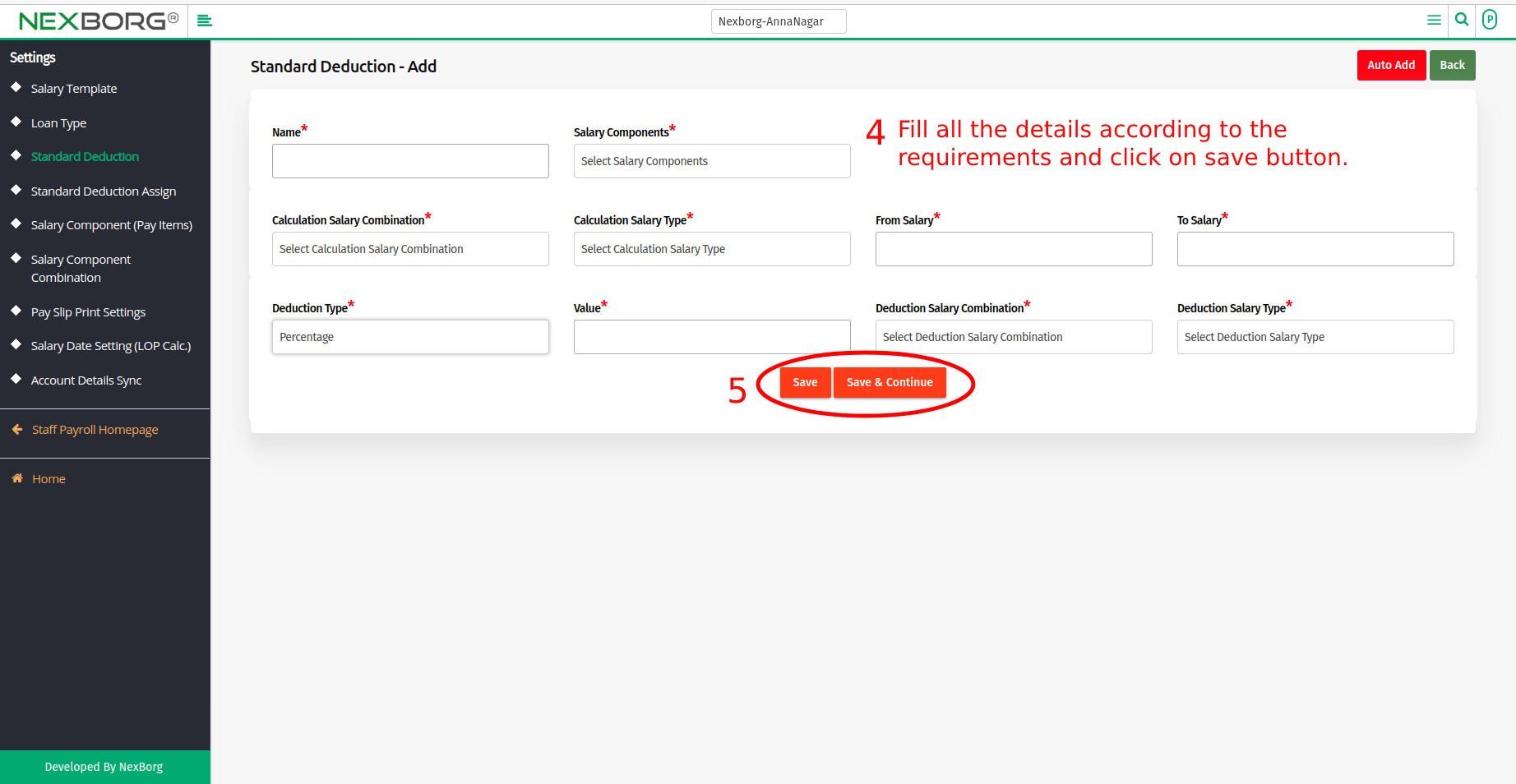

- Step 01: Give a new Standard Deduction Name.

- Step 02: Select the Salary components as ESI (Employees State Insurance) or EPF (Employees Provident Fund )or Professional Tax.

- Step 03: Select the combination type in which the salary is calculated. Eg., (Basic+ DA +HRA) , (EPF(Basic+DA), Gross.

- Step 04: Select the Salary calculation Type as Assigned or Earning.

- Step 05: Provide the salary range by entering the From salary amount and To salary amount.

- Step 06: Select the Deduction type as Fixed (Fixed amount paid to an employee) or Percentage. (Deduction – An amount of money that is taken by an employer from an employee's pay, for income tax, and insurance).

- If Fixed is selected, enter the correct value. If Percentage is selected, select Deduction Salary combination and Deduction Salary Type as Assigned or Earning from the drop-down menu.

- Click on Save or Save & Continue button.

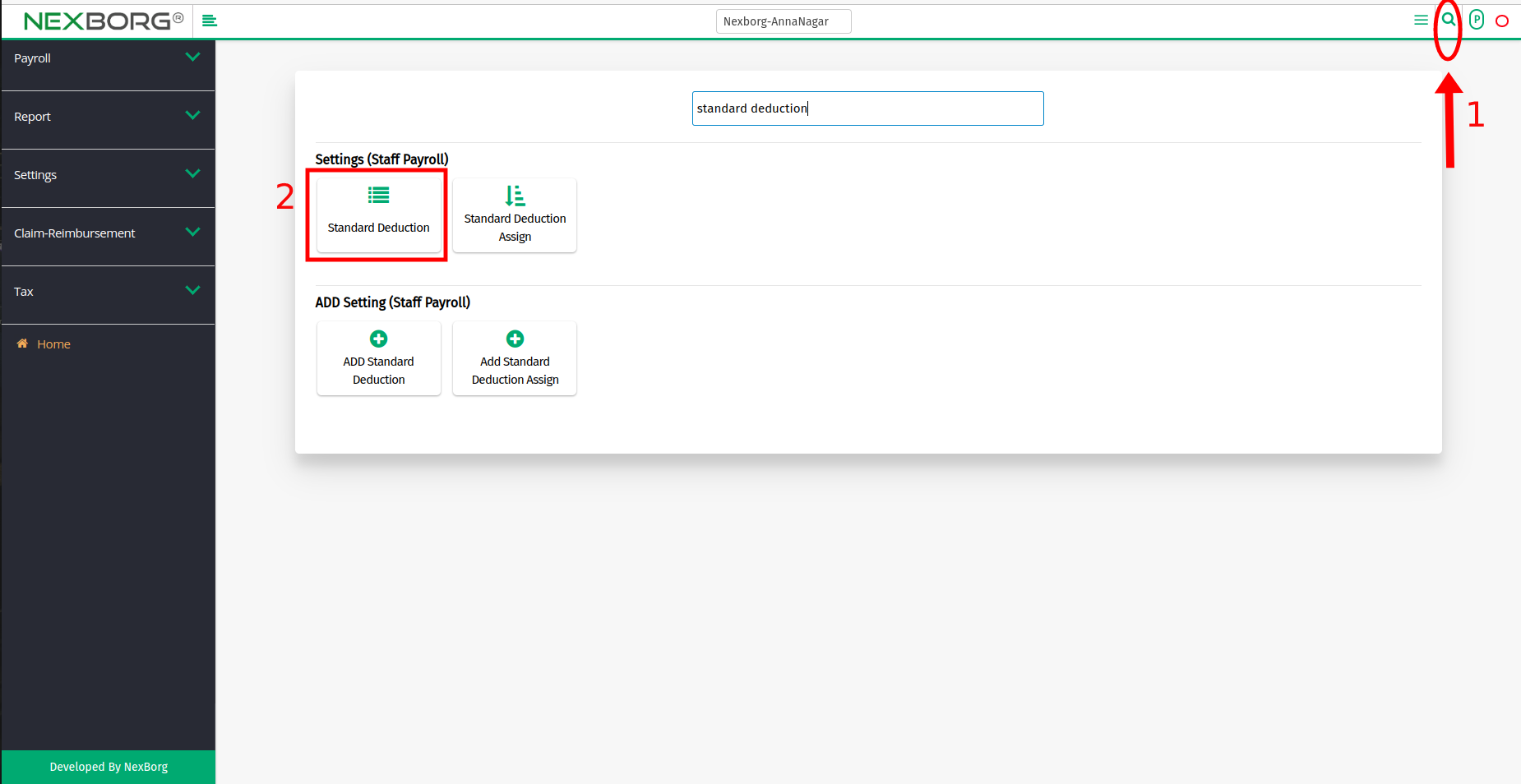

- Method 2: Click on the highlighted search box in the page's header or type in the item you want to access in the Search box and choose the filtered result. This will give you quick and easy access to the menu.

To Update Employee Standard Deduction

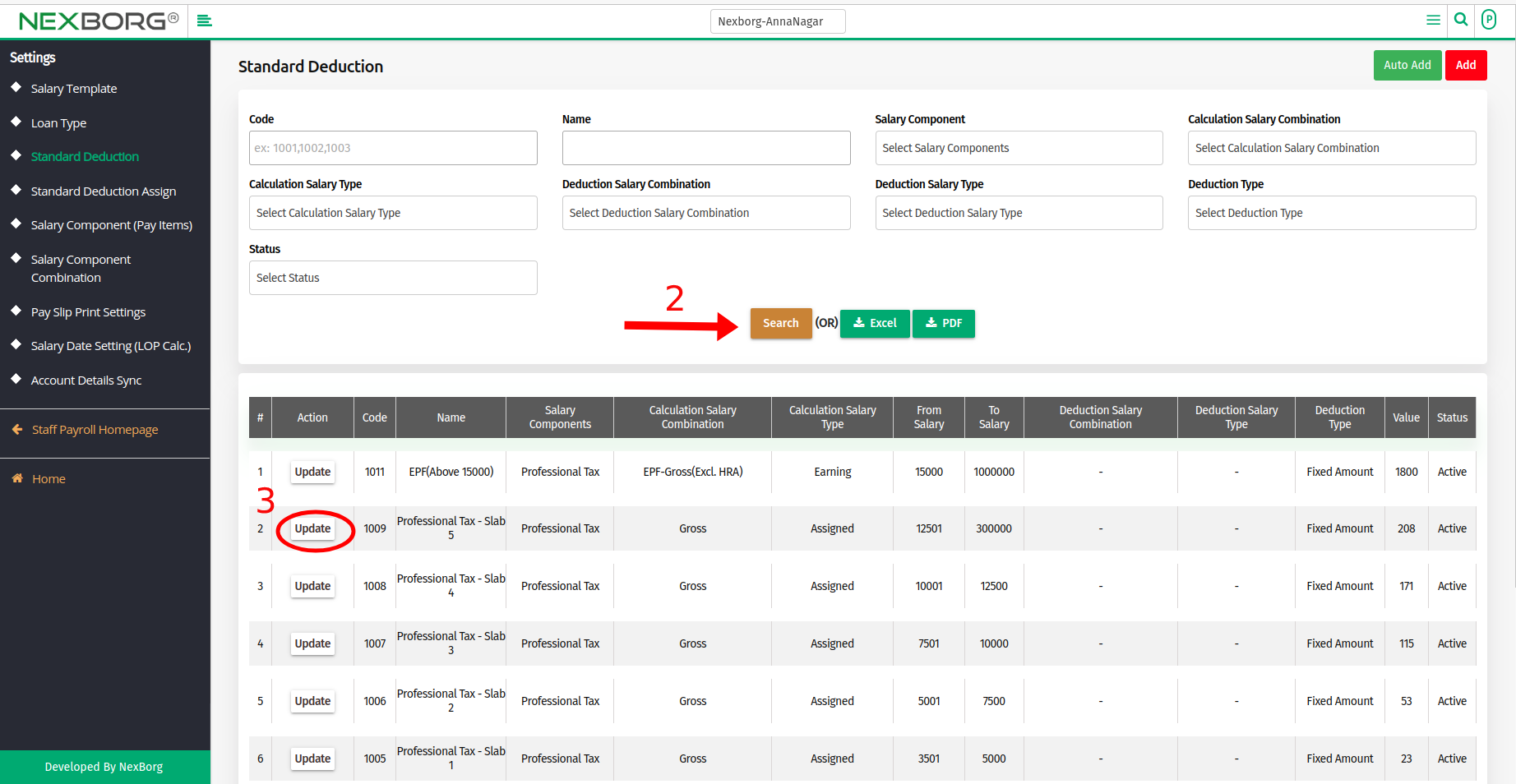

- Go to the Payroll module --> Click on Settings on the left navigation bar --> Select Standard Deduction or use the Standard Deduction button in the Settings menu.

- Click the "Search" button to view the list of standard deduction methods.

- Click the "Update" action of the specific standard deduction, it navigates to the Standard Deduction - Update page.

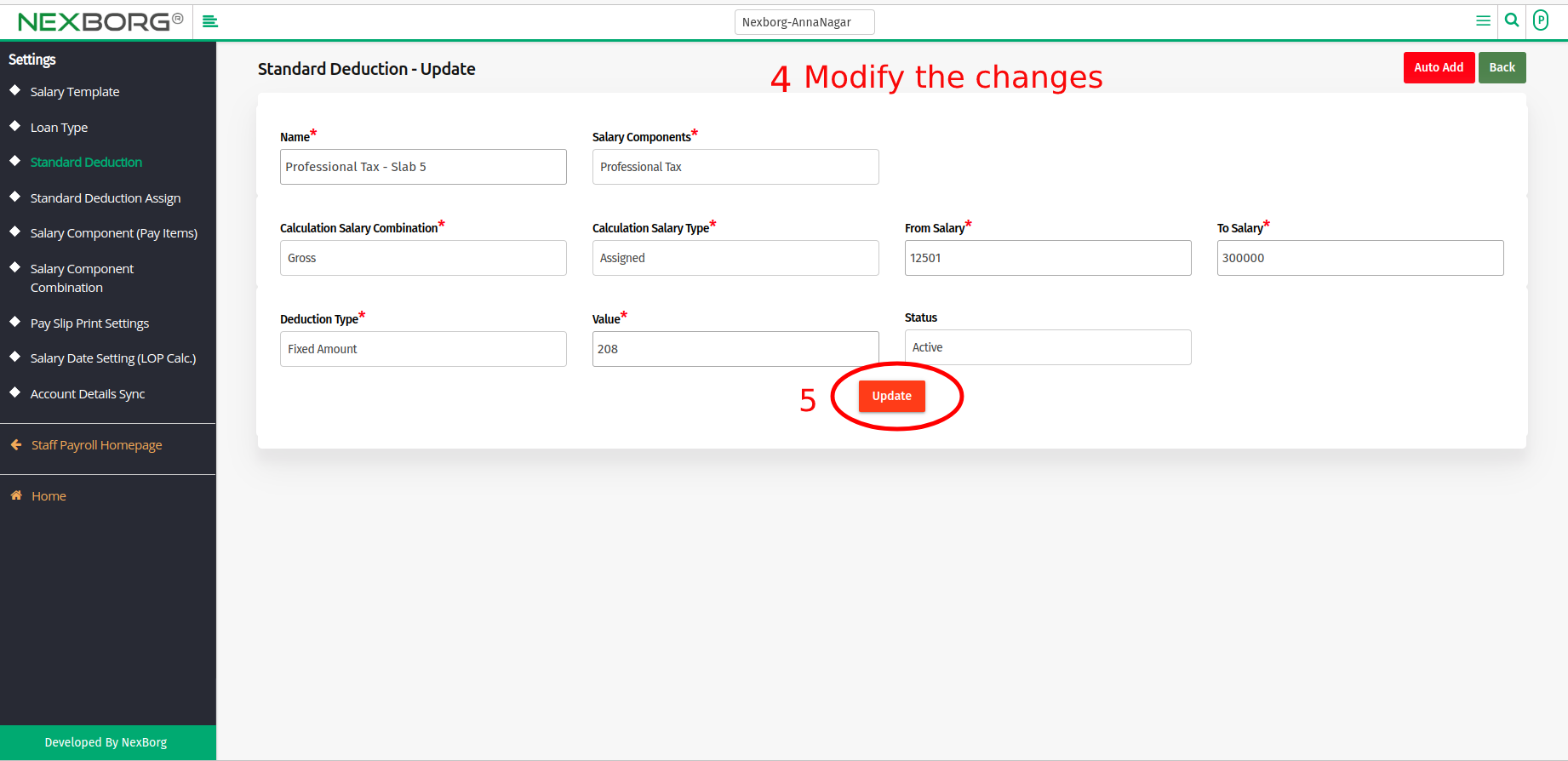

- Modify the changes, and click on the "Update" button.